Expatriates tax planning in the Baltic's 2017 tax seminar was held jointly with the Swedish Chamber of Commerce on March 9th, 2017. Presentation was provided by Valters Gencs, Latvian tax attorney focusing on presentation of tax avoidance issues in the Baltic's.

Seminar on Expatrites taxation in the Baltic’s 2017 covered dividend taxation in Latvia in the context of tax avoidance.

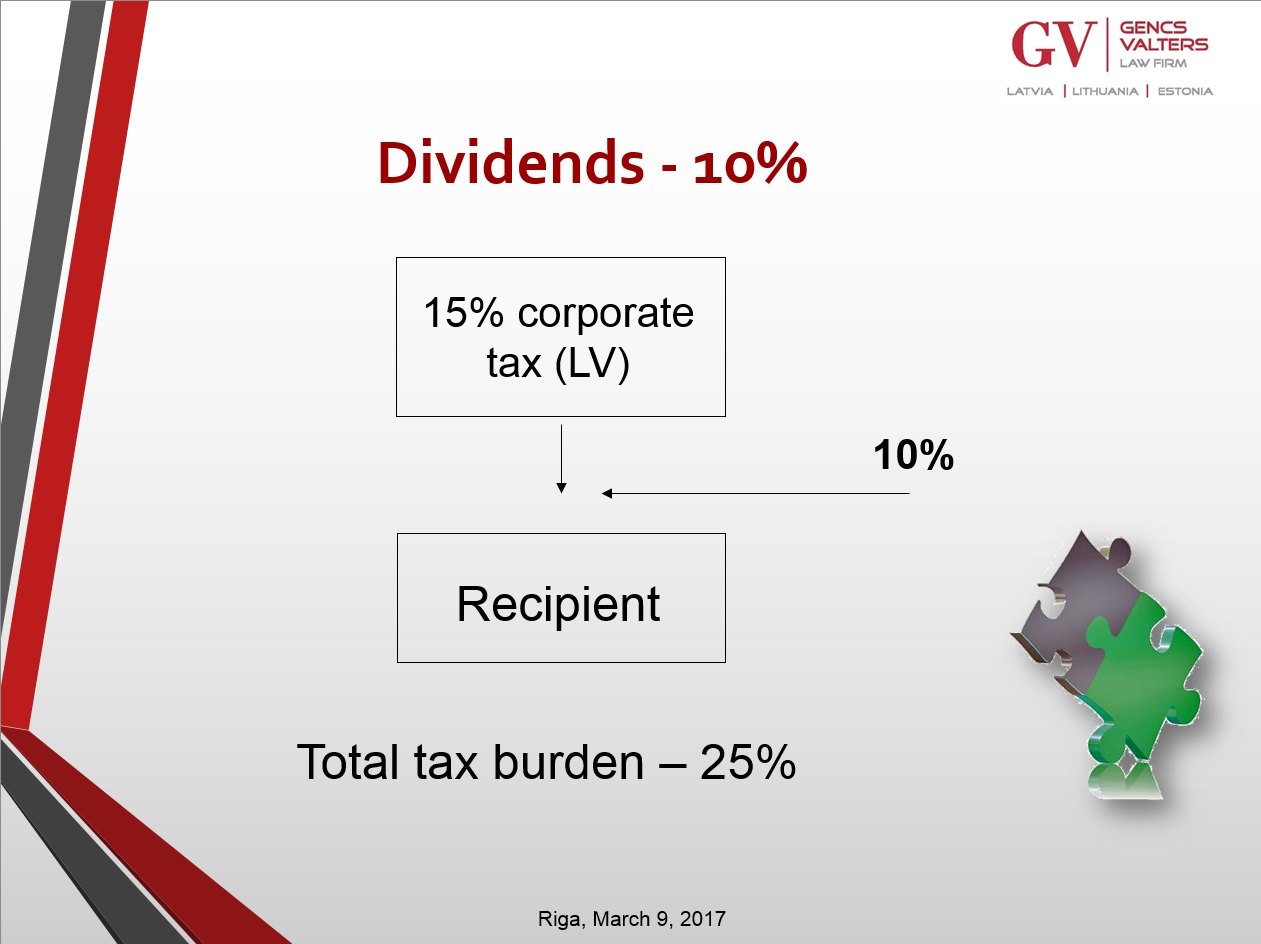

Corporates are subject to a fifteen per cent corporate tax for their income. When a shareholder of an enterprise receives dividends, one is subject to ten per cent Capital Income Tax. Consequently the tax burden amounts to a total of twenty five per cent.

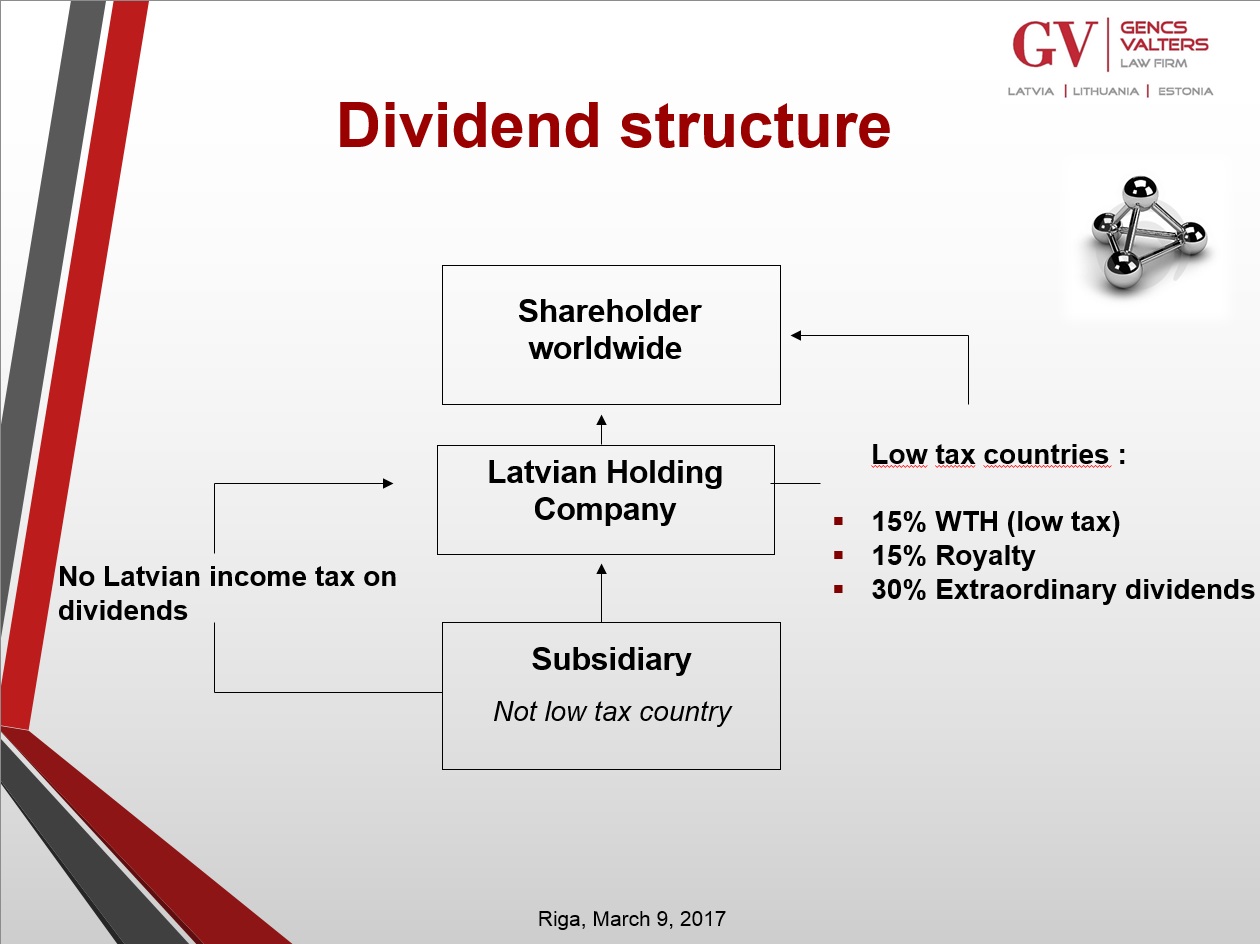

Given a case, when a holding company residing in Latvia receives dividends from a subsidiary located abroad in a ‘not low tax country’, the holding company is not subject to any corporate tax. However, when a shareholder is residing in a low tax jurisdiction (e.g. Lichtenstein and Panama) one may be subject to additional taxation. For instance Latvia imposes a fifteen per cent withholding tax on dividends, fifteen percent tax on royalties and thirty percent tax on extraordinary dividends.

Should you have any questions about taxation in Lithuania, Estonia or Latvia, please do not hesitate to contact our English speaking lawyers at info@gencs.eu.

T: +37167240090

F: +37167240091