According to Latvian law there are three different types of tender offers: compulsory, voluntary and final.

Mandatory tender offer

It is mandatory that an offer addressed to other stockholders to redeem the stocks belonging thereto be expressed by a person who:

- directly or indirectly acquires the controlling interest of a company (voting rights arising from the stocks in such an amount that the voting rights of such person at the meeting of stockholders comprises or exceeds half of the total number of votes); and

- at the meeting of stockholders has voted in favour of the matter regarding the exclusion of the stocks from a regulated market. Such a vote may not be a closed vote.

Voluntary tender offer

For a person attempting to acquire more than 10 percent of voting rights, but less than the controlling interest in a stock company, can that person make a voluntary tender offer. This can be especially practical in cases where the person is planning to perform a takeover via so-called proxy battle. In proxy battle a group of shareholders are persuaded to join together and gather enough shareholder proxies to win a corporate vote.

Competing tender offer

A voluntary stock redemption offer shall be considered a competing stock redemption offer which has been expressed with regard to the stock of a target company while another offer is in effect with regard to these stocks. It must be taken into account that a competing stock redemption offer may not be made by a person who:

- is in the same group of companies with the initiator of the offer, which is in force;

- has entered into an agreement with the initiator of the offer which is in force regarding joint action with regard to the offer; and

- has received an authorisation from the initiator of the offer, which is in force to vote in the name thereof at the meeting of stockholders of the target company.

Leveraged buyouts (LBO) in Latvia

It is worth mentioning that in Latvia law does not prohibit acquiring companies via leveraged buyouts (LBO) in which the acquisition of another company is done by using a significant amount of borrowed money (bonds or loans) to meet the cost of the takeover. In this acquisition, the assets of the company being acquired can be used as collateral for the loans (in addition to the assets of the acquiring company).

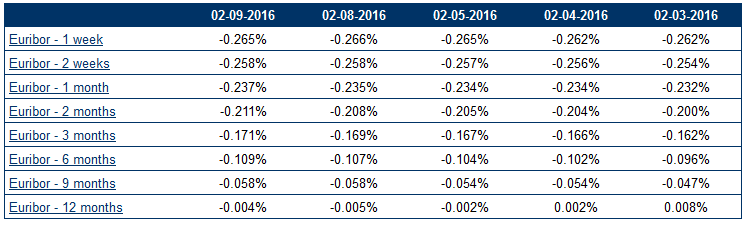

For the

companies evaluating the required internal rate of return (IRR) and hurdle-rate

for a leveraged buyout (LBO), it is good to know the interest rates offered by

banks. Interest rates offered by banks in Europe correlate strongly with the

Euribor rates. The Euribor rates are considered as the most important reference

rates in the European money market. The Euribor rates provide the basis for the

price and interest rates of all kinds of financial products such as saving

accounts and mortages. Here are the recent Euribor rates:

As it can be seen from the table, loaned money is currently cheap in the

European money market. This should provide your firm a high internal rate of

return in a successful leveraged buyout in the Baltics.

Please do not hesitate to contact us if you are in a need of a professional M&A advisor or you have any questions regarding tender offers in Latvia. Along with assistance regarding acquisitions we can also offer your company advice on how to protect your business against hostile takeovers and notorious actions resulting in i.e. greenmail payments. Greenmail is a term that refers to the money which is paid by a target company to another company (also called corporate raider) that has acquired majority of the target company's stock. In this scenario the greenmail payment is made in an effort to stop the hostile takeover bid.