Buyouts are regulated by the Law on Securities in Lithuania, which identifies 3 types of buyout procedure for public companies - voluntary offer, mandatory offer and a ‘squeeze-out’ procedure. Official offer procedures apply to securities issued by public companies registered in Lithuania.

Mandatory takeover

An official buyout offer becomes mandatory to the shareholder when he directly or indirectly, or in conjunction with other parties acting together acquires at least 40 percent of the voting rights of the company. A mandatory buyout requirement also arises when a decision to exclude the company’s shares from trading is taken (‘delisting’).

Voluntary takeover

Voluntary takeover bid is the takeover bid announced at the discretion of the person and under the terms established thereby to the holders of securities to purchase all voting securities issued by the offered company or part thereof, and (or) securities representing the right to acquire the voting securities.

A voluntary tender offer can be launched by any party willing to acquire all or part of the shares of the targets. If 40 percent of shares have been acquired in such an offering, the abovementioned obligation to make a mandatory bid no longer applies.

Obligation to sell the shares (‘Squeeze-out’)

A person directly or by a voluntary buyout offer acquiring 95% or more of all the shares (major shareholder) is entitled to demand that minority shareholders sell their shares to the major shareholder and the minority shareholders are obliged to do so. If the 95% of shares have been acquired in a mandatory or voluntary offer, the price paid for the shares in a squeeze-out has to be equal to the price paid during mandatory or voluntary offer. In any other case, the buyer has to offer a fair price for the shares. Upon receiving the request of the majority shareholder to buy-out the remaining shareholders, the company has to promptly notify the each shareholder, the Securities Commission and market operator of the request. Minority shareholders then have 90 days to sell their shares to the majority shareholder.

Leveraged buyouts (LBO) in Lithuania

In Lithuania, it is not prohibited to acquire companies via leveraged buyouts (LBO), i.e. when the acquisition of another company is done by using borrowed money (bonds or loans) to meet the cost of the takeover. Often, the assets of the company being acquired are used as collateral for the loans in addition to the assets of the acquiring company.

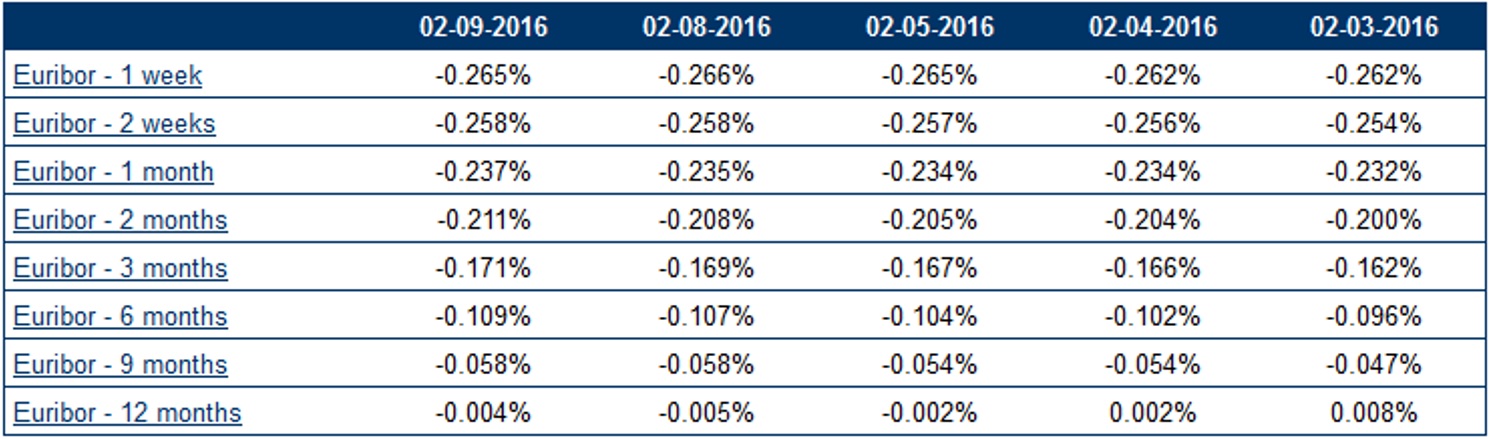

For the companies evaluating the required internal rate of return (IRR) and

hurdle-rate for a leveraged buyout (LBO), it is good to know the interest rates

offered by banks. Interest rates offered by banks in Europe correlate strongly

with the Euribor rates. The Euribor rates are considered as the most important

reference rates in the European money market. The Euribor rates provide the

basis for the price and interest rates of all kinds of financial products such

as saving accounts and mortgages. Here are the recent Euribor rates:

Please do not hesitate to contact us if you are in a

need of a professional M&A advisor or have any questions regarding tender

offers in Lithuania. Along with assistance regarding acquisitions we can also

offer your company advice on how to protect your business against hostile

takeovers and notorious actions resulting in, for example, greenmail payments.