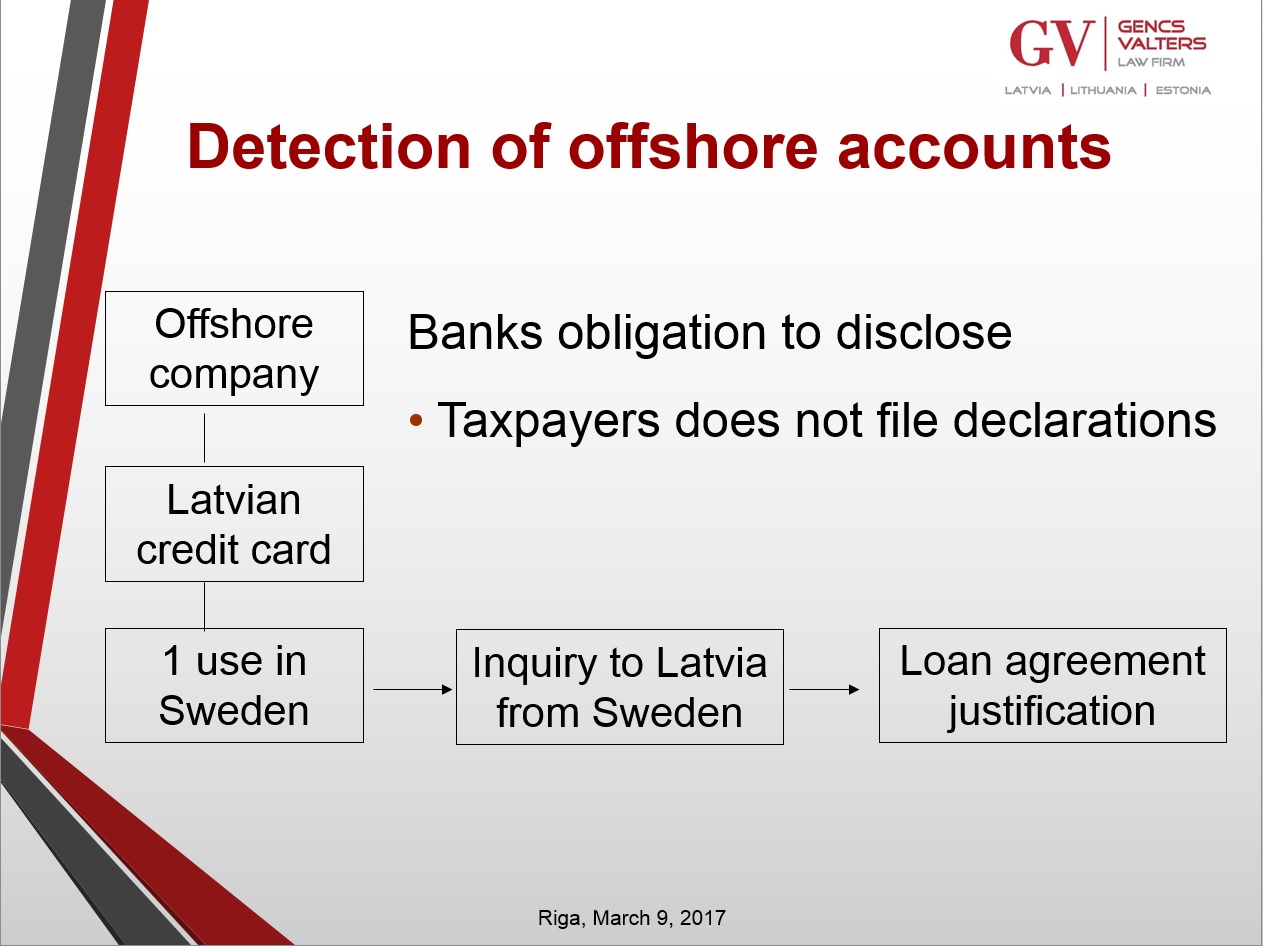

Expatriates tax planning in the Baltic's 2017 tax seminar dealt with detection of offshore accounts and tracking tax evasion frauds in context of tax avoidance.

Tackling tax evasion and frauds

The information reports by Latvian banks have to be provided to the Latvian Tax administration for detection and prevention of violations, what results as reduced tax amount paid into the State budget or increased amount deductible from the budget, for what the liability is established in the tax laws, as well as for detection and prevention of offenses for evasion of tax payments and payments equivalent thereto and fraud.

The description of other slides will follow.